EU VAT law is being reformed. In all member states, companies will soon have to report and file taxes digitally to tax authorities on the basis of electronic invoicing. Here’s a look at the filing models that you may soon be working with.

The electronic exchange of invoices includes real time electronic reporting to tax authorities. Countries want to use it to help combat VAT fraud. Companies will soon have to adapt their systems, sometimes with considerable effort. In the long term, however, cost savings can be expected from e-reporting.

E-reporting is changing from a trend to the standard

The current system based on recapitulative statements will be replaced by a digital reporting system for transactions within the EU by 2028. In this case, notification to the authorities is transaction-based that occurs with invoicing, which means that information about expected sales can be recorded faster and in better quality. All sales that are currently reported as a recapitulative statement would be affected.

EU: VAT in the Digital Age

In December 2022, the EU Commission proposed a regulation titled VAT in the Digital Age (ViDA) that covers electronic reporting obligations in the context of e-invoicing. An EU-wide reporting system for business-to-business (B2B) sales is to be introduced, in which companies transmit data from electronic invoices to the authorities in real time. Once transposed into national law, member states will be able to closely track the VAT levied and intervene upon suspicion of fraudulent practices.

Central approval platforms for tax authorities

A transaction-based invoice reporting process is already used in many countries, both for business to government (B2G) and business-to-business (B2B). This kind of e-reporting was first introduced in Latin America, which reduced the so-called VAT gap in countries like Chile, Mexico and Brazil, by 50 percent in some cases. It was followed by China with its Golden Tax Project. In Africa, Tunisia is a pioneer in e-reporting.

Half of EU member states, including Hungary, Spain, Italy and most recently France, have already introduced a variant of electronic invoice reporting. In numerous countries in Northern Europe, such as Germany, they are being planned.

The trend is moving from a post-audit procedure to central approval platforms for tax authorities. Overall, the importance of international standards and networks such as Peppol is also growing.

Two models: V and Y

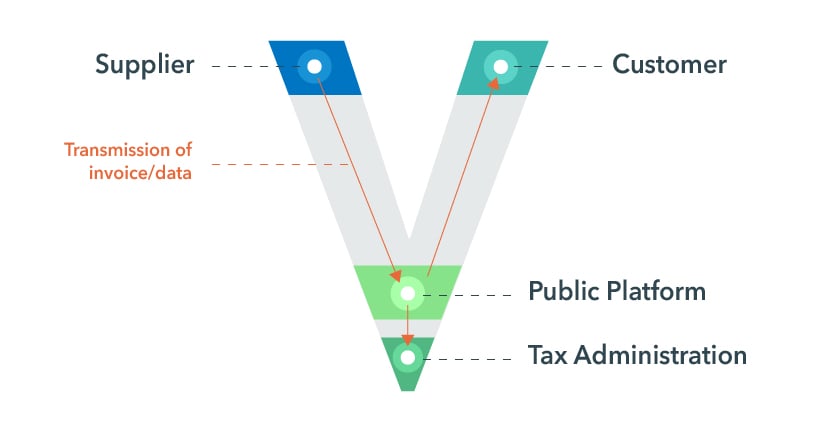

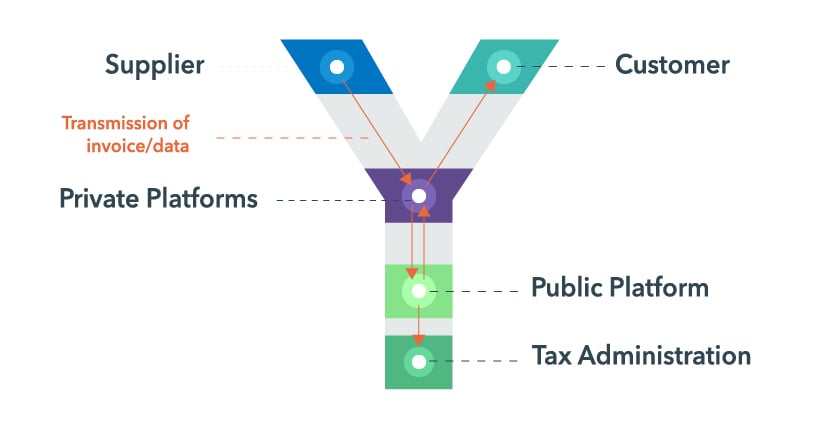

What reporting models do companies need to prepare for in countries that do not yet have an e-reporting system, and how do they work? There are two leading concepts for electronic invoice reporting systems in Europe – named V and Y. With their shapes, the letters stand for the different number of contact points through which companies communicate with each other and with the tax authorities when exchanging invoices. The V-model has three, while the Y-model has four contact points.

The V-Model

In Europe, the V-Model, also known as the Clearing Model, currently dominates: in Italy, for example, companies have to send their invoices to their business partners via a central server of the tax authorities and are not allowed to use private channels for this purpose.

The Y-Model

With the Y-structure, companies are alternatively allowed to send invoices via private channels such as EDI. Decentralized transmission in interaction with IT service providers is therefore also permitted, so that companies are free to choose the platform and the channel for the user. You may also choose the service provider and make the best possible use of existing structures. The Y-model is used in France, for example.